We’re continuing our look at what the passage of Senate Bill 30 does to the Kansas tax landscape going forward. This bill contained many changes, so we’re breaking it down. The enactment of SB 30 slowly reverses most of the itemized deduction rollbacks that went into play in tax year 2013. Taxpayers in Kansas may not have noticed that their itemized deductions were silently slashed a few years ago, as the overall tax rate decreases offset the pain of the lost deductions at that time. Although SB 30 increases the tax rates retroactive to January 1, 2017, Kansas itemized deductions don’t ramp back up until tax year 2018.

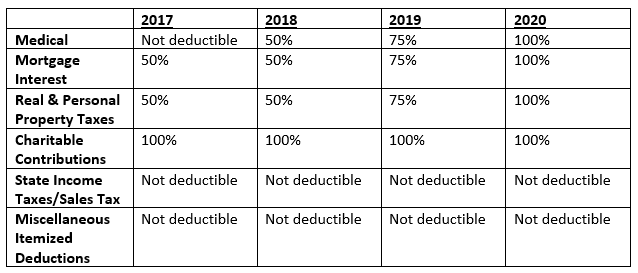

As with most Kansas tax laws, the State’s calculation for itemized deduction starts with allowable Federal deductions. The 2017 itemized deductions have the same calculation that was set out in the 2012 law changes. Going forward, itemized deductions start gaining traction. The most notable of the comeback kids….. medical expenses. For federal purposes, taxpayers get a deduction for their medical expenses over 10% of adjusted gross income. Medical expenses allowed as a Kansas itemized deduction zip from 0% in 2017 to 50% in 2018 of the federally deductible amount. Medical, mortgage interest, real estate and personal property tax deductions all increase in 25% increments in 2019 and 2020.

The State hasn’t historically allowed itemized deductions for state income and sales taxes paid, and those expenses will continue to be nondeductible. Also, conspicuously absent from the changes in SB 30, the reinstatement of miscellaneous itemized deductions (unreimbursed employee expenses, safe deposit box rent, casualty and theft losses, investment fees, gambling losses, tax preparation fees, etc). Those deductions still lose their power at the state level. To talk to one of our tax professionals about all the exciting changes wrapped up in SB 30, call us at 785-234-3427 and check back on our blog for updates on the other provisions that changed with this legislation.